fsa health care limit 2022

If youre married your spouse can put up to 2850 in an FSA with their employer too. 12 2022 300 am.

Irs Announces 2023 Hsa Limits Blog Medcom Benefits

You can contribute pretax dollars to fund.

. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Facts about Flexible Spending Accounts FSA They are limited to 2850 per year per employer.

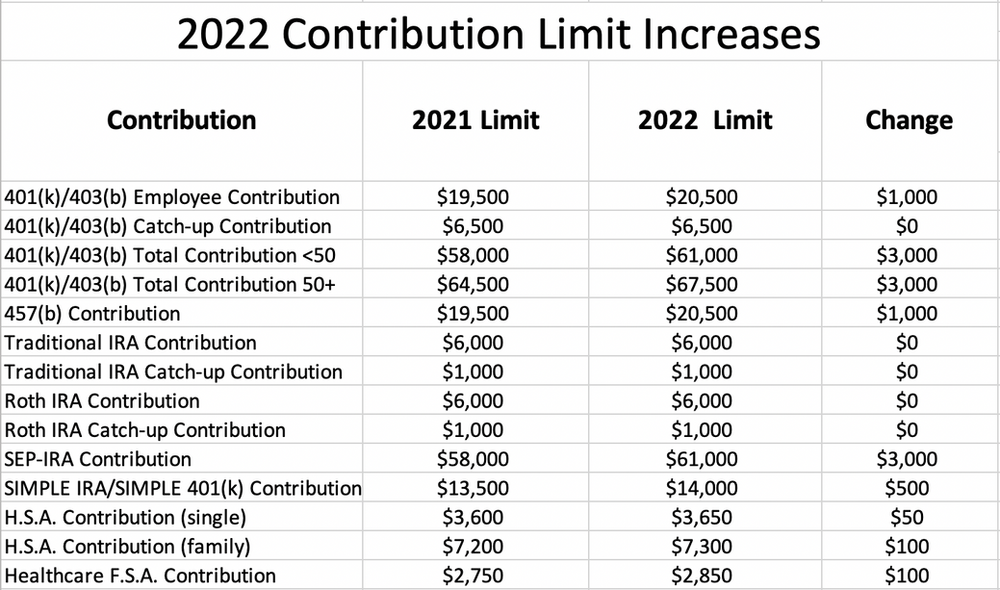

There are three types of. See below for the 2022 numbers along with comparisons to 2021. Health 9 days ago What is FSA annual limitThe IRS limits how much can be contributed to an FSA account per year.

IRS Announces 2022 Health FSA Qualified. Updated with 2023 limits Flexible Spending Accounts FSA have been around for a while now and many families use them as a tax advantaged way to save for health care and. However the IRS allows you to keep a certain amount from year to year.

1 day agoBy Ron Lieber. Employees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct. This is a 100 increase from the 2021.

Below youll find our address and hours parking and transportation information and the other health services we offer at our Piscataway VA Clinic. The IRS announced an increase to the Health FSA contribution limit for 2022 raising your maximum contribution amount to 2850. Meanwhile single workers who want to.

HSA contribution limit employer employee. For medical expense FSA. The DCFSA annual limits for pre-taxed contributions increased to 10500 up from 5000 for single individuals and married couples filing jointly and to 5250 up from 2500.

Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans. The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121. Health flexible spending accounts health fsas the payroll deduction contribution limit for 2022 plan years is 2850 an increase of 100.

Ron Lieber has maxed out his flexible spending account for over a decade and has definitely used it for massage therapy. This is called your carryover In 2022 this carryover is 570. Health Care Fsa Limits 2022.

The new 2-digit calling. So if you had 1000 in your account at the end of this year you could carry it all over into 2022. The usual carry-over limit is 550 You can also contribute up to the.

2022 2021 Change. A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. 2022 Health Fsa Limit.

3 rows employees in. A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses. The annual contribution limit for your health care flexible spending accounts health fsas is on the rise for 2022 according to the society for human resource management.

For help with FSAs or any other financial. Health 9 days ago For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. As a result the IRS has revised contribution limits for 2022.

In 2023 employees can put away as much as 3050 in an FSA an increase of about 7 from the current tax years cap of 2850. 18 as the annual contribution limit rises to. This is an increase of 100 from the.

10 as the annual contribution limit rises to. A Flexible Spending Account FSA is an employee benefit that allows you to set aside money on a pre-tax basis for certain health care and dependent care expenses.

2022 Retirement Plan Contribution Limits

What Is An Fsa Definition Eligible Expenses More

Irs Allows Midyear Enrollment And Election Changes For Health Plans And Fsas

Irs Announces 2022 Limits For Health Fsas And Transit Benefits Scout Benefits Group

The 2021 Limits For Fsa Commuter Benefits And Adoption Assistance

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

Irs Releases 2022 Limits For Qsehra Health Fsa And Commuter Benefits Core Documents

Flexible Spending Account Contribution Limits For 2022 Goodrx

Fsa Hsa Contribution Limits For 2022

2022 Health Fsa Contribution Cap Rises To 2 850

Flexible Spending Account Contribution Limits For 2022 Goodrx

Announcing 2022 Fsa Commuter And Adoption Contribution Limits

2023 Fsa Commuter Contribution Limits Released Millennium Medical Solutions Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Account Fsa Basics Faqs For 2022 2023